Have You Considered Investing in Adani Green Energy?

Have you ever wondered how the rising focus on renewable energy could shape your investment portfolio?

With Adani Green Energy at the forefront of India’s green revolution, understanding its share price target from 2025 to 2030 could be the key to aligning your investments with a sustainable future.

In this article we have discussed Adani Green Energy Stock Price Prediction from 2025-2030 with various factors affecting the stock.

Let’s explore this exciting opportunity together.

Table of Contents

Adani Green Energy Share Fundamentals

Adani Green Energy Stock Fundamentals

| Metric | Value |

|---|---|

| Market Cap | ₹1,42,468 Cr |

| ROE | 12.90% |

| P/E Ratio (TTM) | 126.32 |

| EPS (TTM) | 7.12 |

| P/B Ratio | 13.47 |

| Dividend Yield | 0.00% |

| Industry P/E | 22.54 |

| Book Value | 66.77 |

| Debt to Equity | 6.38 |

| Face Value | 10 |

| 52 Week Low | ₹870.25 |

| 52 Week High | ₹2,174.10 |

| Open | ₹890.00 |

| Prev. Close | ₹898.55 |

| Volume | 72,56,773 |

| Lower Circuit | ₹808.70 |

| Upper Circuit | ₹988.40 |

Why Adani Green Energy Is a Key Player in Renewable Energy

Adani Green Energy Limited (AGEL) is one of India’s largest renewable energy companies, focusing on solar and wind projects.

With the global push toward sustainable energy solutions, Adani Green Energy has emerged as a leader in transitioning India’s energy landscape.

Here’s why it stands out:

- Massive Renewable Capacity: The company has committed to achieving 45 GW of renewable capacity by 2030.

- Strategic Projects: Projects like the hybrid wind and solar park in Rajasthan underline its innovative approach.

- Global Recognition: Adani Green Energy’s inclusion in various sustainability indices reflects its growing international reputation.

These factors make it a promising candidate for long-term investments, especially as governments worldwide prioritize clean energy.

Adani Green Energy Share Price Analysis: Past Trends and Current Status

Historical Performance

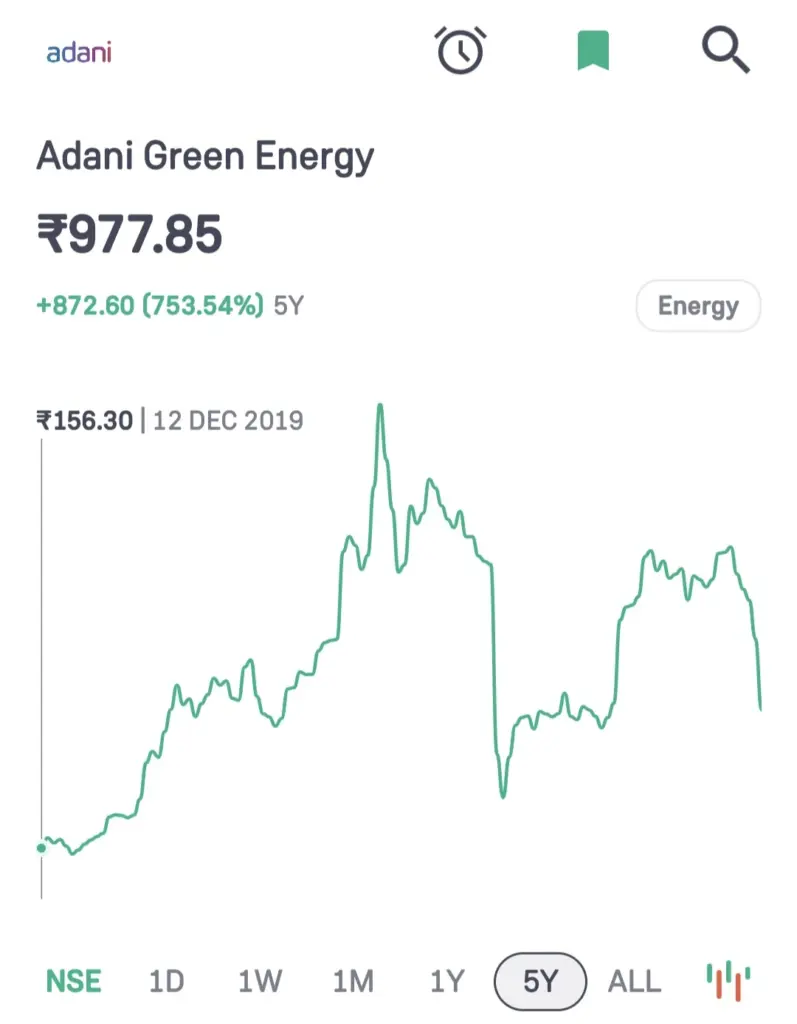

Adani Green Energy has shown remarkable growth in its share price over the past few years.

From being a lesser-known name to becoming a market favorite, its stock performance mirrors the company’s business expansion.

- 2020-2023 Trends: The share price surged significantly as the company scaled its renewable energy projects.

- Recent Developments: In 2023, Adani Green Energy secured several large-scale contracts, further solidifying its position.

The following graph clearly shows its growth in upward direction for the long term.

Adani Green Energy Share Price Targets From 2025 to 2030

Projections

Based on current growth trends and market analysis, here are the projected share price targets for Adani Green Energy:

Adani Green Energy Share Price Target (2025-2030)

| Year | Price Target (₹) |

|---|---|

| 2025 | ₹3,300 |

| 2026 | ₹4,200 |

| 2027 | ₹5,100 |

| 2028 | ₹6,300 |

| 2029 | ₹7,400 |

| 2030 | ₹8,500 |

Adani Green Energy Share Price Target 2025

Adani Green Energy’s share price target for 2025 is projected at ₹3,300, driven by the company’s aggressive expansion in renewable energy and its growing dominance in the sector.

With India’s strong push towards clean energy and global investors showing confidence in the company’s large-scale solar and wind projects, Adani Green Energy is well-positioned for significant growth.

The company’s strategic initiatives, including partnerships and capacity expansions, are expected to enhance operational efficiency and profitability making ₹3,300 a realistic price target for 2025 based on current trends and market analysis.

Also Read:

- Adani Enterprises Share Price Target From 2025 To 2030

- SAIL Share Price Target From 2025 To 2030: In-Depth Analysis

- IRFC Share Price Target From 2025 To 2030

- Trident Share Price Target from 2025 To 2030

- Tn Petro Share Price Target From 2025 to 2030

Adani Green Energy Share Price Target 2026

Adani Green Energy’s share price target for 2026 is estimated at ₹4,200, reflecting the company’s continuous growth in the renewable energy sector.

As Adani Green Energy expands its solar and wind power capacity and leverages government incentives for green energy, it is expected to achieve substantial revenue growth.

The company’s focus on sustainability and global renewable energy partnerships positions it as a key player in the market, making the ₹4,200 target achievable.

This growth aligns with increasing global demand for clean energy solutions and Adani’s commitment to becoming a leader in carbon-neutral energy production.

Adani Green Energy Share Price Target 2027

Adani Green Energy’s share price target for 2027 is projected to reach ₹5,100, driven by the company’s aggressive expansion plans and consistent focus on renewable energy projects.

With the growing emphasis on sustainable energy solutions globally, Adani Green Energy is likely to benefit from increasing demand for solar and wind power.

Its robust project pipeline, international collaborations, and technological advancements will further solidify its market position.

As the company scales its operations and captures a larger share of the renewable energy market, the ₹5,100 target seems attainable for long-term investors.

Adani Green Energy Share Price Target 2028

The projected share price target for Adani Green Energy by 2028 is ₹6,300, based on its growth potential in the renewable energy sector, market trends, and performance forecasts.

AThe company is expected to benefit from the increasing demand for sustainable energy solutions and its ongoing expansion initiatives.

This target reflects a positive outlook for the company’s future, assuming it continues to capitalize on these opportunities and performs well in the coming years.

Adani Green Energy Share Price Target 2029

The projected share price target for Adani Green Energy by 2029 is ₹7,400, driven by the company’s continued expansion in the renewable energy sector and its strong growth prospects.

As the global demand for clean energy increases, Adani Green Energy is expected to benefit from its investments in renewable projects and its leadership in the sector.

This target reflects an optimistic outlook for the company’s performance and its ability to maintain growth over the next several years.

Adani Green Energy Share Price Target 2030

The projected share price target for Adani Green Energy by 2030 is ₹8,500, driven by the company’s strong position in the renewable energy sector and its long-term growth potential.

With the increasing global shift toward clean energy, Adani Green Energy is well-positioned to capitalize on this trend through its extensive portfolio of renewable projects.

The target reflects the company’s expected ability to expand its market share, innovate in the sector, and continue generating substantial growth over the next decade.

Key Drivers for Growth

- Expansion of Renewable Projects: The company’s focus on wind-solar hybrid parks and green hydrogen projects will drive revenue growth.

- Government Policies: Favorable policies and incentives for renewable energy will further support its profitability.

- Global Demand for Clean Energy: As international markets seek green energy solutions, Adani Green Energy’s export potential could increase significantly.

Real-Life Example

In 2023, Adani Green Energy announced the commissioning of a 600 MW wind-solar hybrid project in Rajasthan.

This project not only added to its capacity but also showcased its ability to execute complex renewable solutions.

Such milestones reinforce investor confidence and boost share price potential.

Opportunities and Risks of Investing in Adani Green Energy

Opportunities

- Sustainable Growth: With renewable energy being a global priority, Adani Green Energy is well-positioned to capitalize on this trend.

- Long-Term Returns: Investors seeking long-term gains may find this stock appealing, given its consistent growth trajectory.

- Alignment with ESG Goals: Environmental, Social, and Governance (ESG) investing is gaining traction, and Adani Green Energy aligns perfectly with this theme.

Adani Green Energy Share Risks

In addition to regulatory challenges, Adani Green Energy may face several other risks that could affect its performance:

Market Volatility: Fluctuations in energy prices, including the prices of renewable energy credits, could affect revenue generation and profitability.

A downturn in global energy markets could negatively impact the company’s financial performance.

Environmental Risks: Natural disasters or environmental concerns related to the company’s renewable energy projects, such as adverse weather conditions affecting solar or wind energy production, could disrupt operations and impact long-term

Competition: The renewable energy market is becoming increasingly competitive, with both domestic and international companies vying for market share.

Increased competition could lead to pricing pressure or reduced market opportunities for Adani Green Energy.

Technological Risks: As renewable energy technologies evolve, Adani Green Energy faces the risk of technological obsolescence.

The company must continually innovate and invest in cutting-edge technologies to remain competitive in the market.

Financial Risks: The company’s heavy reliance on debt to finance its expansion could expose it to financial risk, particularly in the event of rising interest rates or a downturn in the economy. Increased borrowing costs could affect profitability.

Political and Geopolitical Risks: Political instability, changes in government leadership, or geopolitical tensions in countries where Adani Green Energy operates could lead to disruptions in operations or hinder growth plans.

Supply Chain Risks: Disruptions in the supply chain, such as shortages of critical materials like solar panels or wind turbine components, could delay project timelines and increase costs.

These risks, among others, could pose challenges to Adani Green Energy’s ability to achieve its growth targets and maintain its market position.

How Adani Green Energy Aligns With India’s Renewable Goals

India has set an ambitious target of achieving 500 GW of renewable capacity by 2030. Adani Green Energy is playing a crucial role in this mission:

- Solar and Wind Projects: Its diverse portfolio ensures significant contributions to the country’s energy mix.

- Job Creation: By investing in renewable infrastructure, the company is generating employment and boosting local economies.

- Green Hydrogen Focus: With the world exploring hydrogen as a sustainable fuel, Adani Green Energy’s initiatives in this space could provide an edge.

When To Invest

Let’s consider a scenario. Imagine Adani Green Energy’s stock nearing its 52-week low due to market corrections or temporary setbacks.

For investors, this could be an ideal entry point to capitalize on its long-term growth prospects. Always remember, smart investing involves timing the market and holding onto quality stocks.

Conclusion

As the renewable energy sector continues to gain momentum, Adani Green Energy stands out as a pioneer driving change.

Investing in its shares not only offers the potential for financial growth but also contributes to a sustainable future.

If you’re considering adding green energy stocks to your portfolio, keep an eye on Adani Green Energy’s share price, especially if it dips near its 52-week low.

The future is green, and this could be your chance to grow with it.

What about sharing this article?

we need your feedback !

Kindly share this article with your fellow investors so that they can make appropriate investment decisions.

If you have any question, comment in below comment section.

FAQs

What is the share price target for Adani Green Energy in 2025?

The share price target for 2025 is projected to be around ₹3,500, reflecting growth driven by renewable capacity expansion.

Why is Adani Green Energy important for India’s renewable goals?

Adani Green Energy is a key contributor to India’s mission of achieving 500 GW of renewable energy by 2030, with large-scale solar and wind projects.

What are the risks of investing in Adani Green Energy?

Potential risks include regulatory changes, market volatility, and increasing competition in the renewable energy sector.

Does Adani Green Energy offer dividends?

Currently, the company focuses on reinvesting profits for expansion rather than offering dividends.

How does Adani Green Energy plan to achieve its 2030 goals?

The company aims to achieve its goals by increasing its renewable capacity through strategic projects, partnerships, and innovations in green hydrogen.