Have you ever wondered how companies like Tata Power can shape the future of renewable energy while offering a strong investment opportunity?

If you’re someone looking for long-term growth in your portfolio, understanding Tata Power’s share price target from 2025 to 2030 could be your ticket to informed decisions.

Let’s take a closer look at how this leading energy player might evolve in the coming years.

This article will break down Tata Power share price targets year-by-year, considering its renewable energy shift, growth trajectory, and market influence.

By the end, you’ll have a clearer picture of whether this stock deserves a spot in your portfolio.

Table of Contents

Tata Power Stock fundamentals And Market Overview

Before we discuss the article deeply, let’s have a quick look at Tata Power Share Price fundamentals and financial details.

Tata Power Share Fundamentals and Market Overview

| Metrics | Values |

|---|---|

| Market Cap | ₹1,30,402 Cr |

| Operating Efficiency (OE) | 11.12% |

| P/E Ratio (TTM) | 4.82 |

| P/E to Sales Ratio (PES) | 11.72 |

| P/B Ratio | 3.87 |

| Dividend Yield | 0.49% |

| Industry P/E | 23.95 |

| Book Value | ₹105.40 |

| Debt to Equity | 1.73 |

| Face Value | ₹1 |

Market Overview

| 52 Week Low | ₹257.05 |

| 52 Week High | ₹494.85 |

| Open | ₹411.50 |

| Previous Close | ₹408.10 |

| Volume | 71,11,608 |

| Lower Circuit | ₹367.30 |

| Upper Circuit | ₹448.90 |

Tata Power Share Price History

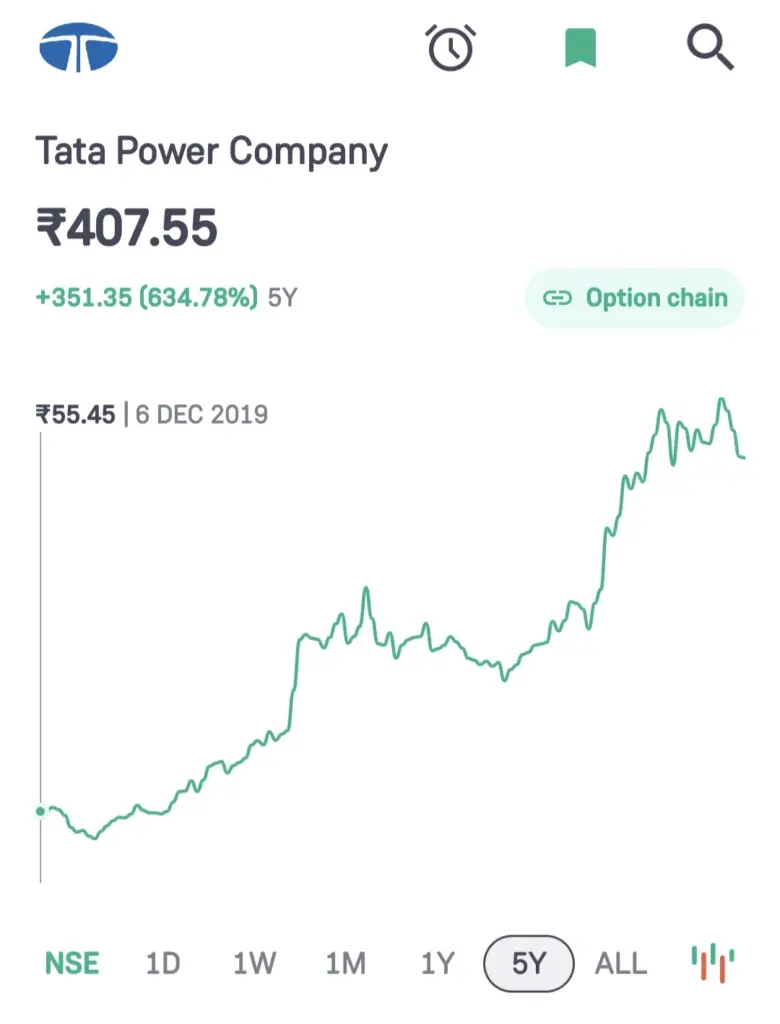

You see, back in December 2019, Tata Power’s stock was trading at just ₹55.45.

It was a time when the markets were relatively steady, and the company was still focused on traditional power generation.

But things started to shift. Fast forward to the 2020-2021 period, and you’ll notice a steady rise in the share price.

This was largely driven by Tata Power’s strategic move into renewable energy and EV charging infrastructure.

Investors started noticing the potential of these new-age power solutions, which brought in a wave of confidence.

By mid-2022, the graph shows a sharper incline.

This is the point where the stock broke its previous highs and started gaining momentum, crossing ₹250.

It wasn’t just a lucky break—this period aligned with global trends in clean energy and Tata Power’s strong execution of solar and wind energy projects.

And then, towards late 2023 and into 2024, you can see the graph climbing even higher, hitting ₹407.55.

At this stage, Tata Power has become a major player in India’s green energy revolution, riding on a 634.78% growth over five years.

Investors clearly believed in their vision of a sustainable future!Why is this important?The steady upward trend shows that Tata Power is not just growing—it’s transforming.

From being a traditional utility player to becoming a leader in renewable energy, this graph is proof of how strategy and market trends can drive phenomenal growth.

It’s inspiring, isn’t it? A ₹10,000 investment back in 2019 would be worth more than ₹73,000 today!

Also Read:

- Tata Steel Share Price Target From 2025 2030: Best Forecast

- Tata Motors Share Price Target From 2025 to 2030

- TATA ELXSI Share Price Target From 2025 To 2030

- Bajaj Hindusthan Sugar Share Price Target From 2025 to 2030

- Bandhan Bank Share Price Target From 2025 to 2030

- MTNL Share Price Target from 2025 to 2030: A Comprehensive Analysis

- GNFC Share Price Target from 2025 to 2030: An In-Depth Analysis

- IRCTC Share Price Target from 2025 to 2030

- Vodafone Idea Share Price Target from 2025 to 2030

Tata Power Stock Price Forecast From 2025-2030

Tata Power Share Price Target From 2025 to 2030

| Year | Price Target (₹) |

|---|---|

| 2025 | ₹520 |

| 2026 | ₹640 |

| 2027 | ₹750 |

| 2028 | ₹890 |

| 2029 | ₹1030 |

| 2030 | ₹1190 |

Tata Power Share Price Target 2025:

The Tata Power share price target for 2025 is ₹520, reflecting its growing dominance in the renewable energy sector.

By 2025, Tata Power is expected to solidify its position as a major renewable energy provider in India.

With increasing investments in solar and wind projects, the company aims to meet the Indian government’s ambitious renewable energy targets.

Currently, Tata Power is aggressively expanding its solar rooftop and EV (electric vehicle) charging infrastructure across the country.

For example, Tata Power has already set up over 50,000 solar rooftop installations and 10,000 EV charging stations.

These initiatives not only contribute to environmental sustainability but also boost its revenues and market perception.

Investor Insights

Tata Power’s pivot towards renewable energy could be the catalyst for its share price to touch ₹520 by 2025.

The company’s commitment to innovation and partnerships, such as with Tata Motors for EV adoption, make it a stock to watch.

Tata Power Share Price Target 2026

The Tata Power share price target for 2026 is ₹640, thanks to steady revenue growth and operational efficiency.

Tata Power’s efforts in modernizing energy solutions should start yielding visible results by 2026.

The company is expected to introduce advanced technologies such as smart grids and energy storage systems, ensuring uninterrupted power supply and reduced dependency on conventional energy sources.

Take this example: In 2023, Tata Power partnered with the Rockefeller Foundation to launch “TP Renewable Microgrid Ltd.” With such projects in the pipeline, the company could revolutionize how rural India accesses electricity.

What It Means for Shareholders

If Tata Power delivers on its promises, ₹640 as a share price target for 2026 feels achievable.

The company’s ability to scale its operations while reducing its carbon footprint will likely attract more ESG (Environmental, Social, and Governance) investors, adding momentum to its stock price.

Tata Power Share Price Target 2027

Looking at 2027, the Tata Power share price target is ₹750, as the company cements its leadership in the green energy sector.

Growth Drivers in 2027

By 2027, Tata Power might be operating with a significantly reduced dependency on coal-based plants.

As the company transitions further into renewables, its profit margins are likely to improve.

Furthermore, the global push for clean energy is expected to benefit companies like Tata Power that have a strong foothold in the sector.

Let’s not forget Tata Power’s massive consumer base.

The company serves over 12 million customers, a number that is likely to grow due to urbanization and increased electricity demand.

Its foray into providing sustainable solutions to residential and industrial clients could act as a game changer.

Investment Outlook

With a projected share price of ₹750, Tata Power’s stock in 2027 could reflect its resilience and ability to capitalize on clean energy trends.

Tata Power Share Price Target 2028

The Tata Power share price target for 2028 is ₹890, driven by its alignment with the global EV boom.

What Sets 2028 Apart

By 2028, the electric vehicle market in India is expected to be in full swing, and Tata Power will likely play a pivotal role in supporting this transformation.

With an extensive network of EV charging stations already in place, the company is poised to capture a significant share of the growing demand for EV infrastructure.

For instance, Tata Power’s collaboration with state governments and automobile manufacturers ensures that it remains a key player in the EV revolution.

Additionally, its innovative solutions like battery swapping for two-wheelers and three-wheelers could further enhance its revenue streams.

A Closer Look at ₹890

If Tata Power continues to expand its EV-focused projects, reaching a share price of ₹890 by 2028 seems plausible.

The combination of EV infrastructure, renewable energy, and technological advancements makes this a strong growth story.

Tata Power Share Price Target 2029

The Tata Power share price target for 2029 is ₹1,030, as the company benefits from economies of scale and increased profitability.

By 2029, Tata Power is likely to have optimized its operations to achieve higher efficiency.

Its large-scale solar farms, advanced battery storage facilities, and widespread EV charging network should contribute significantly to its bottom line.

With the Indian government providing subsidies and incentives for renewable energy projects, Tata Power’s capital expenditure will likely yield higher returns.

Such initiatives ensure long-term value creation for shareholders.

Crossing the ₹1,000 mark would be a psychological win for Tata Power and its investors.

At this stage, the company’s stock might be viewed as a stable yet growth-oriented asset, attracting both retail and institutional investors.

Tata Power Share Price Target 2030

The Tata Power share price target for 2030 is ₹1,190, reflecting its maturity as a renewable energy leader.

By 2030, Tata Power’s business model is expected to revolve almost entirely around renewable energy.

With reduced operational costs and enhanced energy efficiency, the company could deliver consistent profits.

Moreover, its partnerships in the global market might open doors to international projects, further boosting its valuation.

One real-life example is Tata Power’s ambition to export renewable energy solutions to neighboring countries like Nepal and Bhutan.

Such initiatives could provide additional revenue streams and cement its status as a regional energy leader.

A share price of ₹1,190 by 2030 would represent a steady CAGR (Compound Annual Growth Rate) from 2025.

This growth is achievable if Tata Power continues to capitalize on renewable energy trends and execute its projects efficiently.

Factors Affecting Tata Power Share Price

Shift to Renewable Energy

Tata Power’s transition from conventional coal-based power generation to renewable energy sources significantly impacts its share price.

Expansion in solar, wind, and EV infrastructure is expected to drive future growth.

Government Policies and Incentives

Favorable policies, subsidies, and incentives for renewable energy projects can positively influence the company’s growth and share price. Any regulatory changes could also affect its trajectory.

Electric Vehicle (EV) Adoption

The rise in EV adoption and Tata Power’s leadership in building EV charging networks are key growth drivers. Increased demand for EV infrastructure is likely to boost revenues.

Market Demand for Green Energy

With increasing global emphasis on clean energy, Tata Power stands to benefit from the growing demand for sustainable energy solutions, attracting ESG-focused investors.

Risks Involved in Tata Power’s Growth

- Regulatory Risks

Changes in government policies, environmental regulations, or tariff structures could pose risks to Tata Power’s growth plans. Delays or cancellations of subsidies might affect profitability. - Project Execution Challenges

Large-scale renewable energy projects require significant capital and timely execution. Delays, cost overruns, or technological challenges can negatively impact revenue and investor confidence. - Competitive Market

Tata Power faces stiff competition from other established players and new entrants in the renewable energy and EV infrastructure sectors. Increased competition could pressure profit margins. - Economic Slowdowns

Global or domestic economic slowdowns might reduce demand for electricity and clean energy solutions, impacting the company’s revenue and growth targets. - Fluctuations in Input Costs

Volatility in raw material costs or supply chain disruptions could increase operational expenses, potentially affecting profit margins and share price.

Understanding these factors and risks is crucial for anyone considering an investment in Tata Power shares.

While the company has a promising future, investors must weigh the opportunities against the potential challenges.

Conclusion

Tata Power’s journey from ₹520 in 2025 to ₹1,190 in 2030 shows the company’s potential to grow alongside India’s renewable energy aspirations.

Investing in Tata Power shares when they are trading near their 52-week low could provide significant upside over the long term.

Remember, stocks like Tata Power benefit from strong fundamentals and clear growth drivers, making them ideal for patient investors.

If you’re looking for a blend of sustainability and profitability in your portfolio, Tata Power might just be the stock for you.

What do you think? Will Tata Power achieve these ambitious targets? Let us know your thoughts!

FAQs

What is the Tata Power Share Price Target for 2025?

The Tata Power share price target for 2025 is ₹520. This target reflects the company’s growing investments in renewable energy, solar installations, and EV infrastructure, all of which are expected to drive revenue growth and market presence.

Why is Tata Power’s share price expected to grow by 2030?

Tata Power’s focus on renewable energy, smart grids, EV charging infrastructure, and sustainable energy solutions positions it for long-term growth. By 2030, the company is expected to mature as a renewable energy giant, achieving a share price target of ₹1,190 through improved profitability and global expansion.

Is Tata Power a good investment for long-term growth?

Yes, Tata Power shows great potential as a long-term investment due to its commitment to clean energy and innovation. With consistent growth in share price targets projected from ₹520 in 2025 to ₹1,190 in 2030, it offers strong upside potential for patient investors, especially when purchased near its 52-week low.

What role does EV infrastructure play in Tata Power’s growth?

Tata Power is heavily investing in EV charging networks and battery swapping solutions to support India’s EV revolution. By 2028, its extensive EV infrastructure is expected to significantly contribute to its revenues, supporting a share price target of ₹890 for that year.

What are the risks of investing in Tata Power?

While Tata Power has strong growth drivers, risks include regulatory changes, project execution challenges, and competition in the renewable energy space. Investors should monitor these factors closely before committing to long-term investments.