Tata Motors, one of the most iconic brands under the Tata Group, has established itself as a leading player in the automotive sector.

Known for its innovative vehicles, strong global presence, and commitment to sustainable transportation, Tata Motors continues to capture investors’ attention.

With the increasing demand for electric vehicles (EVs), the company’s forward-looking strategies, and its stronghold in both domestic and international markets, Tata Motors seems poised for substantial growth in the coming years.

In this article, we’ll explore Tata Motors’ share price targets from 2025 to 2030, examine key factors driving its performance, and discuss the risks investors should consider.

Table of Contents

Before diving into price projections, let’s take a quick look at Tata Motors’ current market performance:

Tata Motors Share Price Market Overview

TATA MOTORS Stock Details

| Details | Values |

|---|---|

| 52 Week Low | ₹670.70 |

| 52 Week High | ₹1,179.00 |

| Open | ₹771.90 |

| Prev. Close | ₹771.90 |

| Volume | 89,23,538 |

| Lower Circuit | ₹694.75 |

| Upper Circuit | ₹849.05 |

TATA MOTORS Fundamentals

| Metric | Values |

|---|---|

| Market Cap | ₹2,84,191 Cr |

| ROE | 32.99% |

| P/E Ratio (TTM) | 8.52 |

| PES (TTM) | 90.58 |

| P/B Ratio | 2.81 |

| Dividend Yield | 0.81% |

| Industry P/E | 21.29 |

| Book Value | ₹274.55 |

| Debt to Equity | 1.05 |

| Face Value | ₹2 |

Tata Motors has shown steady growth in recent years, with particular emphasis on its EV division.

The company has also benefited from its premium subsidiary, Jaguar Land Rover (JLR), which continues to perform well in key global markets.

Tata Motors Stock Price Forecast 2025-2030

The projected growth of Tata Motors’ share price is primarily driven by its focus on innovation, global expansion, and leadership in the EV space.

Below are the estimated targets:

TATA MOTORS Share Price Target From 2025 to 2030

| Year | Price Target (₹) |

|---|---|

| 2025 | ₹1,244 |

| 2026 | ₹1,365 |

| 2027 | ₹1,480 |

| 2028 | ₹1,550 |

| 2029 | ₹1,644 |

| 2030 | ₹1,789 |

Tata Motors Share Price Target 2025

The Tata Motors Share Price Target 2025 is projected to reach ₹1,244.

This optimistic outlook is supported by the company’s strong push into the electric vehicle market, including its popular Tata Nexon EV and upcoming EV models.

Tata Motors has also strengthened its presence in the global EV industry through partnerships and acquisitions, such as its acquisition of Jaguar Land Rover (JLR).

The growing demand for EVs, coupled with government incentives for sustainable transportation, will likely boost Tata Motors’ revenue and drive its share price upward.

In 2025, the company’s leadership in the commercial vehicle segment, alongside its dominance in the EV market, is expected to help it achieve significant growth.

However, while these factors provide growth opportunities, investors should also consider external economic challenges that might influence stock performance.

Tata Motors Share Price Target 2026

By 2026, the Tata Motors Share Price Target is estimated at ₹1,365.

This forecast reflects the company’s growing revenue streams from both domestic and international markets.

Tata Motors’ global expansion of EVs and JLR’s increasing contribution to its financial performance will be key drivers.

The company’s focus on cutting-edge technologies, such as autonomous vehicles and connected car solutions, positions it as a strong contender in the global automotive industry.

Moreover, Tata Motors is expected to further benefit from its cost-reduction initiatives and operational efficiency, which will enhance profit margins.

As the adoption of green mobility solutions gains momentum, the company’s strategic investments in EV infrastructure will play a critical role in maintaining its growth trajectory.

Also Read:

- TATA ELXSI Share Price Target From 2025 To 2030

- Bajaj Hindusthan Sugar Share Price Target From 2025 to 2030

- Bandhan Bank Share Price Target From 2025 to 2030

- MTNL Share Price Target from 2025 to 2030: A Comprehensive Analysis

- GNFC Share Price Target from 2025 to 2030: An In-Depth Analysis

- IRCTC Share Price Target from 2025 to 2030

- Vodafone Idea Share Price Target from 2025 to 2030

Tata Motors Share Price Target 2027

The Tata Motors Share Price Target 2027 is predicted to climb to ₹1,480.

This growth projection is attributed to the company’s ability to consistently innovate and cater to changing consumer preferences.

Tata Motors is expected to strengthen its portfolio by launching new EV models and expanding its lineup of premium vehicles under the JLR brand.

Additionally, Tata Motors’ focus on sustainability and carbon neutrality aligns with global trends, further increasing its attractiveness to ESG-focused investors.

While its success in global markets is likely to contribute significantly to its valuation, external challenges such as fluctuating fuel prices and supply chain disruptions may pose some risks.

Tata Motors Share Price Target 2028

By 2028, the Tata Motors stock price target is expected to reach ₹1,550.

The company’s continuous advancements in electric mobility and autonomous technologies will likely solidify its position as a global leader.

The increasing contribution from JLR, particularly in markets like China and the United States, will further boost revenue and earnings.

Tata Motors’ expansion into EV infrastructure, such as charging networks and battery technologies, will play a pivotal role in this growth.

However, competition from global automakers and regional market fluctuations could pose challenges.

Despite this, Tata Motors’ commitment to innovation and diversification makes it a strong player in the automotive industry.

Tata Motors Share Price Target 2029

The Tata Motors stock prediction target for 2029 is ₹1,644. This reflects the company’s ability to capitalize on emerging trends such as AI-driven automotive technologies and advanced EV features.

Tata Motors’ focus on sustainable practices and cutting-edge innovations will likely attract further investments and market share.

In addition to its technological advancements, the company’s growth in commercial vehicle exports and its increasing dominance in domestic markets are expected to fuel its valuation.

While the company shows immense potential, it will need to navigate geopolitical risks, regulatory changes, and competitive pressures from both domestic and global players.

Tata Motors Share Price Target 2030

By 2030, the Tata Motors Share Price Target is projected to reach an impressive ₹1,789.

This reflects the culmination of years of innovation, expansion, and market leadership.

Tata Motors’ ability to adapt to industry transformations, such as the rise of shared mobility and connected vehicles, will be instrumental in achieving this milestone.

The company’s strategic investments in green technologies, partnerships with global players, and its commitment to enhancing customer experiences will further contribute to its long-term success.

However, technological disruptions and changing market dynamics could impact its growth trajectory.

Despite these risks, Tata Motors’ robust financial health and innovation-driven approach make it a highly promising stock for the future.

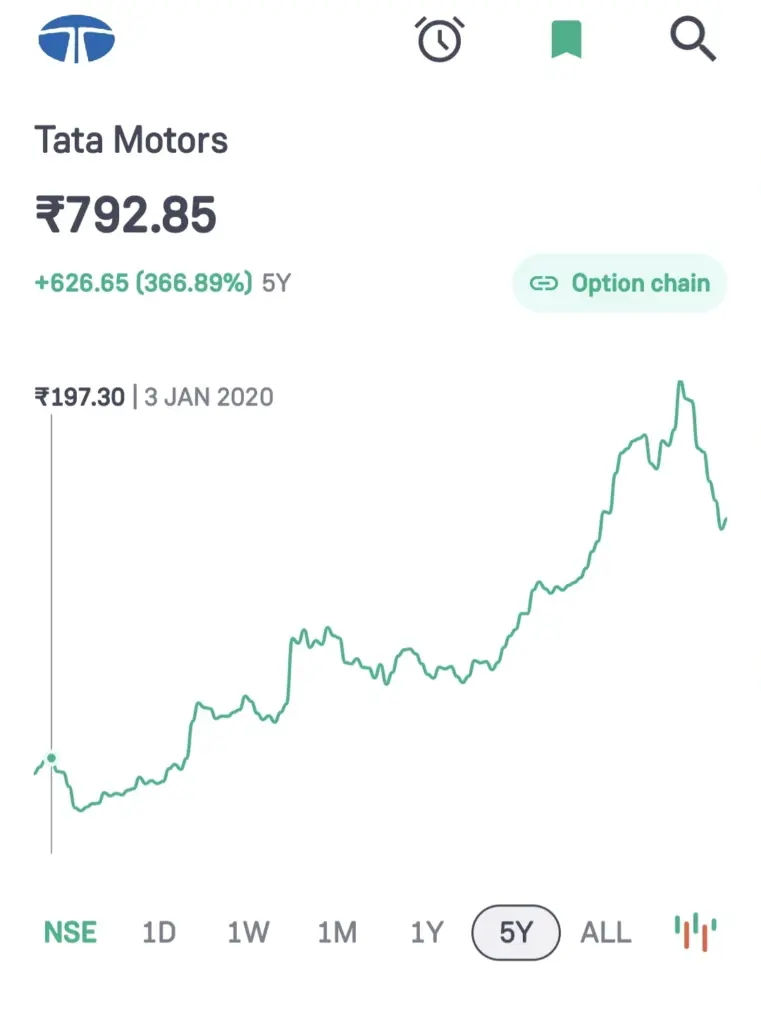

Tata Motors Share Price Graph

This graph presents the 5-year performance of Tata Motors‘ stock price. Here’s a breakdown of the details:

1. Current Share Price

• ₹792.85: This is the latest trading price of Tata Motors’ stock.

2. 5-Year Change

• +₹626.65 (366.89%): Over the past 5 years, the stock has gained ₹626.65 in value, marking an impressive growth of 366.89%.

3. Historical Data

• The graph displays the stock’s price trend over the last 5 years. The stock was priced at ₹197.30 on January 3, 2020, and has since experienced a significant upward trend, peaking and recently correcting.

Factors Affecting Tata Motors Stock Price

Several factors influence the Tata Motors stock price forecast, including:

- Global Demand for EVs: With increasing environmental awareness and government incentives, Tata Motors’ EV segment is expected to experience significant growth.

- Technological Advancements: Investments in autonomous vehicles, AI, and connected car solutions will enhance Tata Motors’ market positioning.

- Economic and Political Factors: Inflation, interest rates, and geopolitical tensions could affect demand and supply chains.

- JLR Performance: JLR’s contribution to revenue and profitability plays a vital role in Tata Motors’ stock performance.

Risks Involved in Tata Motors Stock

Despite its strong growth potential, Tata Motors stock prediction targets are subject to risks, such as:

- Market Volatility: Economic slowdowns, currency fluctuations, and global uncertainties can impact performance.

- Technological Disruptions: Rapid advancements in the automotive industry may require frequent updates, leading to higher costs.

- Competition: Global automakers, including Tesla and Volkswagen, pose significant competition in the EV space.

Conclusion

Tata Motors’ journey from 2025 to 2030 shows remarkable potential, driven by its focus on innovation, sustainability, and global expansion.

With consistent growth in its EV segment and a strong performance from JLR, Tata Motors is well-positioned for long-term success.

However, investors must consider risks and market dynamics before making investment decisions.

Overall, Tata Motors remains a compelling choice for those seeking exposure to the future of mobility and green technologies.

FAQs

Is Tata Motors a good stock to invest in for the long term?

Tata Motors has shown significant growth in the past 5 years, with a 366.89% increase in share price. Its focus on electric vehicles (EVs), strong global presence, and recovery in the automotive industry make it a promising stock for long-term investors. However, it’s essential to analyze market conditions and financial reports before investing.

What is the target price of Tata Motors shares for 2025?

While analysts’ predictions vary, many expect Tata Motors’ share price to reach ₹1,200 to ₹1,400 by 2025, driven by increased EV sales, market expansion, and improved profitability. Please consult a financial advisor for specific guidance.

What are the risks associated with investing in Tata Motors?

Key risks include fluctuating demand in the automotive sector, rising input costs, competition in the EV market, and global economic uncertainties. Additionally, foreign exchange fluctuations can impact the company’s international revenue.

Does Tata Motors pay dividends to its shareholders?

Tata Motors has a relatively low dividend yield of 0.81%. The company typically focuses on reinvesting profits for growth, especially in EVs and other strategic initiatives. Dividend payments are not a significant part of its investor appeal.

How has Tata Motors performed compared to its competitors?

Tata Motors has outperformed many of its competitors in the last five years, achieving a 366.89% growth in share price. The company’s strong EV portfolio, competitive pricing, and focus on innovation have contributed to its superior performance. However, it faces competition from companies like Mahindra & Mahindra and international players like Tesla in the EV market.