TATA ELXSI Share Price Target From 2025-2030

TATA ELXSI has emerged as a leading provider of design and technology services across diverse industries such as automotive, healthcare, and telecommunications.

Its robust focus on innovation and cutting-edge technologies has positioned it for substantial growth in the coming years.

The TATA ELXSI Share Price Target for the period from 2025 to 2030 shows a promising upward trajectory.

From ₹998 in 2025 to an impressive ₹15,789 in 2030, this forecast reflects the company’s ability to capitalize on emerging trends like AI, IoT, and digital engineering solutions.

With its strategic focus on electric vehicles (EVs), autonomous systems, and artificial intelligence, TATA ELXSI continues to cater to industries undergoing rapid technological transformation.

These efforts are complemented by strong financial performance, which has further strengthened investor confidence.

However, as with any stock, investors must consider the risks and market dynamics that could influence the stock price.

In this article, we analyze the TATA ELXSI Share Price Target from 2025 to 2030 based on market trends, growth potential, and other influencing factors.

Table of Contents

Tata Elxsi Share fundamentals

Tata Elxsi Share Fundamentals

| Metric | Value |

|---|---|

| 52 Week Low | ₹6,286.00 |

| 52 Week High | ₹9,200.00 |

| Open | ₹6,405.05 |

| Prev. Close | ₹6,374.55 |

| Volume | 2,51,523 |

| Lower Circuit | ₹5,099.65 |

| Upper Circuit | ₹7,649.45 |

| Mkt Cap | ₹39,652 Cr |

| P/E Ratio (TTM) | 48.54 |

| P/B Ratio | 15.95 |

| Industry P/E | 36.04 |

| Debt to Equity | 0.08 |

| ROE | 32.85% |

| EPS (TTM) | 131.16 |

| Div Yield | 1.10% |

| Book Value | ₹399.24 |

| Face Value | ₹10 |

TATA ELXSI Share Price Target From 2025-2030

| Year | Price Target (₹) |

|---|---|

| 2025 | ₹998 |

| 2026 | ₹10,676 |

| 2027 | ₹11,587 |

| 2028 | ₹12,690 |

| 2029 | ₹13,707 |

| 2030 | ₹15,789 |

TATA ELXSI Share Price Target 2025

The TATA ELXSI Share Price Target 2025 is set at ₹998, marking a significant growth opportunity for investors.

This projection is backed by the company’s increasing presence in digital transformation and software development for the automotive and healthcare industries.

The launch of new products and strategic collaborations with global players have been instrumental in sustaining growth momentum.

In 2025, the company’s emphasis on electric and connected vehicles is expected to drive revenue growth, as global EV adoption continues to accelerate.

Moreover, TATA ELXSI’s expansion into AI-powered solutions and its expertise in user experience design further enhance its competitive edge.

While the ₹998 price target presents a lucrative entry point, investors should be cautious about economic factors and market competition, which could impact performance.

TATA ELXSI Share Price Target 2026

By 2026, TATA ELXSI is forecasted to achieve a share price target of ₹10,676, reflecting its continued focus on high-growth sectors.

The company is expected to benefit from its investments in advanced technologies, such as robotics and cloud computing, which are driving innovation in its core industries.

These efforts align with the company’s strategy to cater to growing demands in the healthcare and automotive sectors.

The TATA ELXSI Stock Price Target 2026 also underscores the success of its global expansion strategy, as it strengthens its footprint in Europe, North America, and Asia.

However, external factors such as geopolitical tensions and currency fluctuations could present challenges to the company’s growth trajectory.

Despite these risks, TATA ELXSI’s strong fundamentals and leadership in digital solutions make it a solid investment for the future.

TATA ELXSI Share Price Target 2027

The TATA ELXSI Share Price Target 2027 is projected at ₹11,587, driven by sustained demand for digital engineering services and technological advancements.

TATA ELXSI’s focus on expanding its AI and machine learning capabilities is expected to enhance its service offerings and provide a competitive advantage.

Furthermore, its partnerships with global clients in industries like transportation and communications will likely contribute to steady revenue growth.

By 2027, TATA ELXSI is also anticipated to benefit from the scaling of its proprietary platforms, enabling clients to innovate faster and reduce costs.

While the ₹11,587 price target reflects strong growth potential, the company faces risks from macroeconomic uncertainties and regulatory changes.

Nevertheless, TATA ELXSI’s diversified portfolio and emphasis on R&D will likely mitigate these risks, ensuring long-term stability.

TATA ELXSI Share Price Target 2028

In 2028, TATA ELXSI is predicted to reach a share price target of ₹12,690, showcasing its ability to sustain growth across various verticals.

The company’s commitment to innovation, particularly in the development of autonomous systems and smart manufacturing, is expected to yield significant returns.

Its leadership in digital transformation services for global clients reinforces its strong market positioning.

The TATA ELXSI Stock Price Forecast 2028 also highlights its increasing focus on sustainability and green technologies, aligning with global trends.

These initiatives are likely to attract ESG-focused investors, further boosting the stock’s performance.

However, competition from other technology providers and market volatility remain potential challenges.

Despite these factors, TATA ELXSI’s robust growth strategies and consistent financial results make it a reliable investment option.

TATA ELXSI Share Price Target 2029

With a share price target of ₹13,707, TATA ELXSI in 2029 is expected to continue its upward growth trajectory.

The company’s ability to adapt to changing market dynamics, coupled with its expertise in advanced technologies, will be key drivers of this performance.

The growth in demand for connected devices and smart solutions is likely to strengthen TATA ELXSI’s foothold in the technology space.

By this time, the company’s focus on enhancing operational efficiencies and delivering value-added services will further solidify its leadership.

The TATA ELXSI Share Price Target 2029 reflects these factors, while also accounting for potential risks such as evolving customer needs and technology disruptions.

Nevertheless, TATA ELXSI’s strong client relationships and global reach position it well for sustained success.

Also Read:

- Bajaj Hindusthan Sugar Share Price Target From 2025 to 2030

- Bandhan Bank Share Price Target From 2025 to 2030

- MTNL Share Price Target from 2025 to 2030: A Comprehensive Analysis

- GNFC Share Price Target from 2025 to 2030: An In-Depth Analysis

- IRCTC Share Price Target from 2025 to 2030

- Vodafone Idea Share Price Target from 2025 to 2030

TATA ELXSI Share Price Target 2030

The TATA ELXSI Share Price Target 2030 is an ambitious ₹15,789, representing a culmination of years of consistent growth and innovation.

As a leader in digital engineering and design services, the company is poised to leverage its expertise in AI, IoT, and autonomous systems to capitalize on emerging opportunities.

Its strategic investments in cutting-edge technologies and talent acquisition further enhance its long-term prospects.

By 2030, TATA ELXSI’s focus on scaling its operations and diversifying its portfolio will likely pay off, resulting in substantial returns for investors.

The price target highlights the company’s ability to stay ahead in a competitive market while addressing global challenges.

Although risks like technological obsolescence and market competition exist, TATA ELXSI’s robust financial health and innovation-driven approach make it a promising investment for the future.

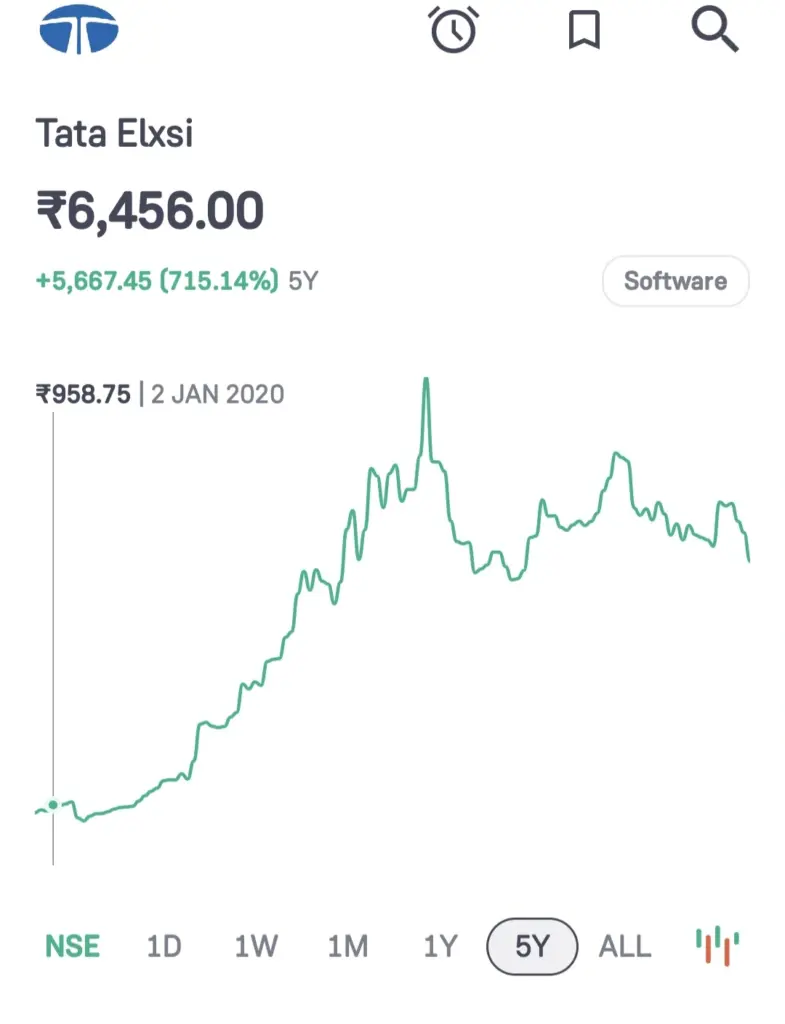

Tata Elxsi Stock Price Graph

The above graph illustrates the 5-year price movement of TATA ELXSI share, highlighting significant growth over this period. Here’s an explanation of the key observations:

Starting Price (January 2020):

The stock price began at ₹958.75 on January 2, 2020. This serves as the baseline for the observed growth trajectory.

Overall Growth (5 Years):

The stock experienced remarkable appreciation, growing by 715.14% over five years to reach ₹6,456.

This indicates a compounded annual growth rate (CAGR) of substantial value, reflecting TATA ELXSI’s performance and investor confidence.

Clearly, Investors who held TATA ELXSI shares over the last five years witnessed significant returns.

The growth is fueled by the company’s leadership in software and engineering solutions, coupled with increasing demand in key sectors like automotive and AI.

However, the stock’s volatility underscores the importance of long-term investment strategies.

Factors Affecting TATA ELXSI Stock Price

Industry Trends: Growing demand for digital transformation and AI integration drives the stock’s value.

Innovation: Investments in R&D and cutting-edge technologies play a crucial role in the company’s success.

Global Expansion: Entry into new markets enhances revenue potential.

Economic Conditions: Fluctuations in global markets and economic policies can impact performance.

Competition: Intense competition from domestic and international players poses challenges.

Risks Involved While Investing in TATA ELXSI

Market Volatility

TATA ELXSI’s share price is susceptible to market volatility, which arises due to factors such as inflation, changes in interest rates, and global geopolitical events.

These macroeconomic conditions can adversely affect investor sentiment and the company’s financial performance, leading to unpredictable stock price fluctuations.

Technological Disruption

Operating in a rapidly evolving tech industry, TATA ELXSI faces the constant risk of technological disruption.

Competitors developing advanced solutions or innovative services could outpace the company, necessitating significant R&D investments to remain relevant.

This may strain profit margins, particularly in the short term, and pose a challenge to maintaining market leadership.

Global Competition

TATA ELXSI operates in a competitive global landscape with numerous firms offering similar services. This competition can result in pricing pressures and the need to innovate continuously. Additionally, regulatory changes or trade restrictions in critical markets could limit the company’s expansion opportunities and impact its revenue.

Dependency on Key Clients

A significant portion of TATA ELXSI’s revenue is derived from a few key clients in industries like automotive, media, and healthcare. Any reduction in business from these clients due to market downturns or budget cuts could severely affect the company’s financial stability.

Economic Slowdown

Global or regional economic slowdowns can reduce demand for TATA ELXSI’s services, particularly in sectors like automotive or consumer electronics.

This cyclical risk may lead to reduced revenues, lower profitability, and decreased investor confidence during economic downturns.

By understanding these risks, investors can make more informed decisions while evaluating TATA ELXSI’s stock as part of their portfolio.

Conclusion

TATA ELXSI stands out as a strong contender in the technology and design solutions sector, making it a compelling choice for long-term investors.

Its consistent growth trajectory, as reflected in various TATA ELXSI Share Price Target predictions, underscores its robust market position and innovation-driven approach.

With promising TATA ELXSI Stock Price Forecasts indicating substantial returns, the company is poised to deliver significant value.

However, investors should carefully consider potential risks such as market volatility and technological disruptions while aligning their strategies with the company’s performance.

FAQs TATA ELXSI Share Price Target

What is the TATA ELXSI Share Price Target for 2025?

The TATA ELXSI share price target for 2025 is ₹998. This forecast is based on the company’s advancements in digital transformation and its focus on growing sectors like electric vehicles and artificial intelligence.

Why is TATA ELXSI considered a promising investment?

TATA ELXSI is recognized for its leadership in design and technology services. Its strategic focus on innovation, cutting-edge technologies, and expanding global operations positions it as a strong long-term investment option.

What industries does TATA ELXSI cater to?

TATA ELXSI serves a range of industries, including automotive, healthcare, telecommunications, and media. It provides advanced technology solutions in areas like AI, IoT, and digital engineering, ensuring it remains at the forefront of technological advancements.

What are the potential risks of investing in TATA ELXSI?

Potential risks include market volatility, technological disruptions, and competition from global technology players. Additionally, economic downturns and evolving market dynamics may impact its growth trajectory.

What is the TATA ELXSI Share Price Target for 2030?

The share price target for 2030 is ₹15,789. This projection reflects the company’s sustained growth, strong financials, and its ability to leverage emerging technologies like AI, IoT, and autonomous systems for long-term success.