Yes Bank Share Price Target 2025-2030: What Investors Need to Know

Yes Bank has been one of the most talked-about stocks in the Indian banking sector.

Its stock price has shown considerable volatility over the years, leading investors to analyze its performance for potential gains.

In this article, we’ll delve into Yes Bank’s share price target, forecast, recent news, and analyst recommendations.

Table of Contents

Yes Bank Stock Price Prediction Overview

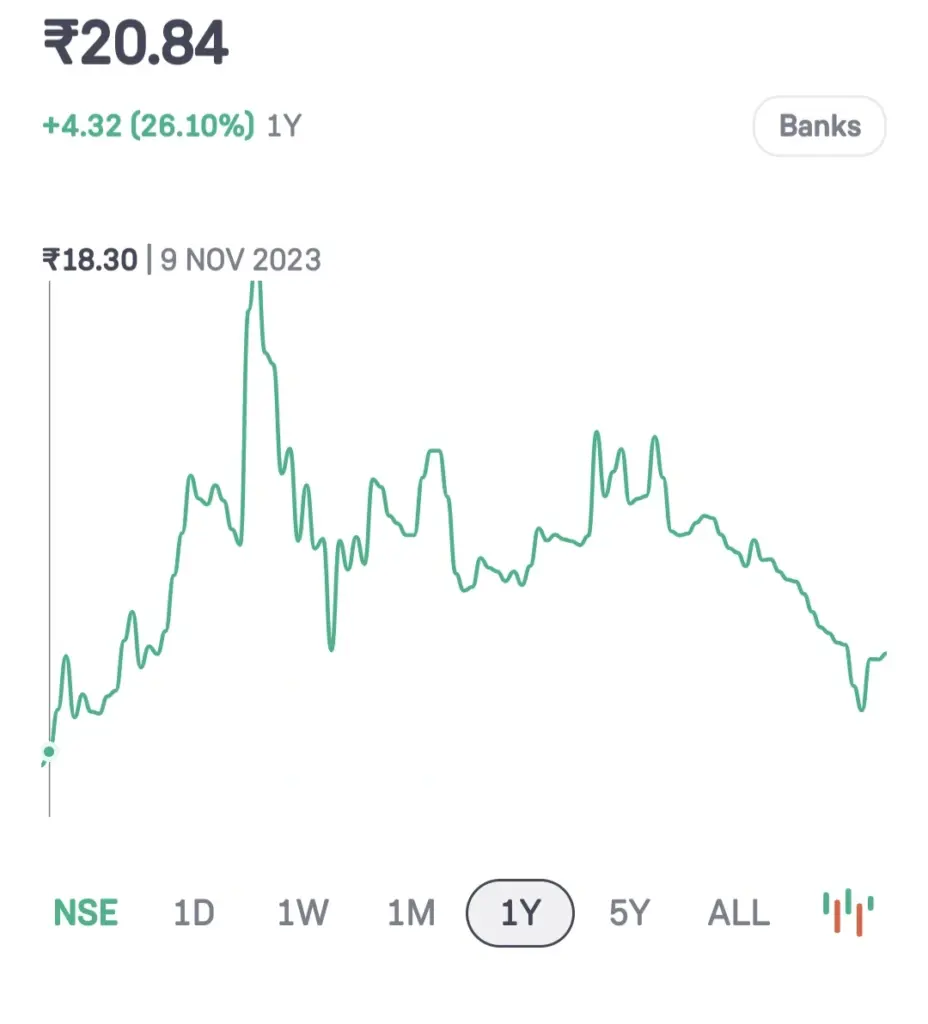

As of recent data, Yes Bank’s share price is ₹20.84, marking a substantial increase of 26.10% over the year.

This growth reflects the bank’s resilience and attempts at a comeback after past challenges.

The share price movements reveal a high level of volatility, with price swings influenced by market sentiment and performance updates.

Recent Performance and Historical Chart Analysis

Over the past year, Yes Bank’s share price showed notable fluctuations. The stock’s price reached ₹18.30 on November 9, 2023, indicating substantial gains from the previous months.

Yes Bank has a market capitalization of ₹64,640 crore and is a major player in the banking sector.

This data reflects market confidence, with many retail and institutional investors taking positions based on its high-risk, high-reward potential.

Yes Bank Share Price Fundamentals

| Market Cap | ₹64,640 Cr |

| P/E Ratio (TTM) | 36.18 |

| P/B Ratio | 1.39 |

| Industry P/E | 13.31 |

| Debt to Equity | NA |

| ROE | 3.86% |

| EPS (TTM) | 0.57 |

| Dividend Yield | 0.00% |

| Book Value | 14.82 |

| Face Value | 2 |

Also Read :

- Reliance Power Share Price Target from 2025 to 2030: Best Review

- Suzlon Share Price Target 2025-2030: In-Depth Analysis

Yes Bank Stock Price Forecast for 2024

Given the growth trajectory, Yes Bank’s share price target is an essential metric for investors.

Various analysts have provided a conservative target due to the bank’s high price-to-earnings (P/E) ratio of 36.18, which is higher than the industry average of 13.31.

Despite this, investor interest remains high, and short-term price targets are estimated between ₹22 and ₹25, reflecting potential upside amid market volatility.

Expert Ratings and Forecasts

Based on the expert analysis by Refinitiv, 73% of analysts have a “Sell” recommendation on Yes Bank stock, while 27% suggest holding the stock.

This rating may indicate caution among experts, who cite the bank’s need to improve fundamentals to justify higher valuations.

Currently, none of the analysts recommend buying Yes Bank shares, which underscores the mixed sentiment around its future performance.

The predictions align with Yes Bank’s fundamentals, such as a Return on Equity (ROE) of 3.86% and an Earnings Per Share (EPS) of 0.57.

These metrics suggest that while the stock may be appealing for short-term gains, its long-term prospects require improvement in profitability and operational efficiency.

Yes Bank Share Price Target for Long-Term Investors

Looking ahead, Yes Bank’s share price forecast indicates potential for growth, albeit with considerable risk.

Long-term investors considering this stock should be aware of its debt-to-equity ratio, which isn’t disclosed, but remains a point of concern among market experts.

The bank’s Price-to-Book (P/B) ratio stands at 1.39, suggesting that it is priced above its book value.

Long-term targets range between ₹30 and ₹35, provided the bank continues on its path of financial restructuring and asset quality improvement.

Yes Bank Share Price Target for 2025-2030

Yes Bank Share Price Targets

| Year | Price Target (₹) |

|---|---|

| 2025 | 54 |

| 2026 | 70 |

| 2027 | 96 |

| 2028 | 120 |

| 2029 | 199 |

| 2030 | 300 |

Yes Bank Share Price Target for 2025

The share price target for Yes Bank in 2025 is projected to be around ₹54.

This price point reflects a conservative estimate based on anticipated recovery and operational improvements.

By 2025, Yes Bank is expected to strengthen its position through better financial management and possibly increased investor confidence.

Yes Bank Share Price Target for 2026

For 2026, the share price target rises to ₹70. This optimistic outlook is based on the bank achieving stronger financial fundamentals, enhancing profitability, and continuing with regulatory compliance.

which would build confidence among retail and institutional investors alike.

Yes Bank Share Price Target for 2027

Yes Bank’s share price target for 2027 is ₹96. This price target assumes that the bank will leverage market opportunities and improve its asset quality, while its management addresses any remaining operational inefficiencies.

By 2027, sustained growth and a strong foothold in the banking sector could further drive up its valuation.

Yes Bank Share Price Target for 2028

Looking ahead to 2028, the share price target is expected to reach ₹120.

This increase reflects a scenario in which Yes Bank capitalizes on a positive economic environment and banking sector growth.

Enhanced operational metrics and profitability are likely to attract more investment, pushing the stock price higher.

Yes Bank Share Price Target for 2029

In 2029, Yes Bank’s share price target is forecasted to be ₹199.

At this stage, the bank may achieve significant market presence and financial stability, with potential new business initiatives adding value.

Improved earnings, along with a stable regulatory environment, could lead to further stock appreciation.

Yes Bank Share Price Target for 2030

The share price target for Yes Bank in 2030 is ₹300. This long-term projection assumes that Yes Bank has fully restructured, demonstrating consistent profitability and growth.

By this year, the bank would likely have diversified its services, retained a strong customer base, and enhanced operational efficiency, contributing to a substantial increase in stock value.

Key Factors Affecting Yes Bank Share Price

Market Sentiment: Yes Bank shares are highly sensitive to news and developments in the banking sector, particularly related to financial stability and asset quality.

Positive news tends to drive quick gains, but concerns about operational stability can result in sharp declines.

Regulatory Changes

The Reserve Bank of India (RBI) has been instrumental in Yes Bank’s turnaround efforts, and future regulatory actions will be key determinants of its performance.

Compliance with banking regulations is vital for improving investor confidence.

Analyst Sentiment and Predictions

Expert recommendations reflect a cautious approach, with a majority advising a sell position.

Analysts’ cautious stance suggests that, while the stock has growth potential, it may still face challenges in achieving substantial long-term gains

Banking Sector Trends:

Yes Bank’s performance can also be linked to trends in the banking sector. A stable financial sector boosts investor confidence, and favorable economic conditions can support price growth.

Conclusion: Should You Invest in Yes Bank?

Yes Bank’s share price target and prediction are influenced by its volatile performance and market sentiment.

While recent price gains have captured investor attention, expert recommendations remain cautious, with a majority suggesting a sell position.

For those considering investment, Yes Bank can be a speculative play for short-term traders, but it requires careful monitoring for long-term investment.

Given its fundamentals, investors should weigh the risks before entering the stock, especially if they are looking for stability.

However, if Yes Bank can continue its restructuring efforts and achieve operational improvements, it could offer significant returns for those willing to take on the associated risks.

FAQs About Yes Bank Share Price

What is Yes Bank’s share price target for 2025?

The share price target for Yes Bank in 2025 is ₹54.

What is Yes Bank’s projected share price for 2030?

The share price target for 2030 is estimated to be ₹300.

Is Yes Bank a good stock to invest in?

Investment decisions depend on individual goals, but experts currently rate Yes Bank with a “Sell” recommendation due to market conditions and performance metrics.

What are Yes Bank’s current fundamentals?

Key fundamentals include a P/E ratio of 36.18, ROE of 3.86%, and a market cap of ₹64,640 Cr.

Where can I find the latest Yes Bank stock news?

You can check reliable financial news websites or stock trading platforms for up-to-date Yes Bank stock information.