Suzlon Share Price Target 2025-2030:

Suzlon Energy has been a key player in India’s renewable energy sector, showing impressive growth over the years.

As India shifts towards sustainable energy sources, Suzlon’s share price has become a focal point for investors.

This article provides a detailed analysis of Suzlon’s share price target for 2025-2030, exploring key financial metrics, market performance, and growth factors that could influence the stock’s future.

Table of Contents

Suzlon Share Current Market Overview

Currently, Suzlon Energy’s share price stands at ₹68.14, reflecting a staggering 2,598.52% increase.

This strong growth has positioned Suzlon as a promising investment in the renewable energy market.

52 week low- ₹30.60

52 week High- ₹86.04

Suzlon Share Fundamental Table

| Fundamental | Value |

|---|---|

| Market Cap | ₹92,235 Cr |

| P/E Ratio (TTM) | 95.97 |

| P/B Ratio | 20.63 |

| Industry P/E | 101.94 |

| Debt to Equity | 0.06 |

| ROE | 21.35% |

| EPS (TTM) | 0.71 |

| Dividend Yield | 0.00% |

| Book Value | 3.30 |

| Face Value | 2 |

Some Key Fundamentals : Suzlon Stock

Market Cap: ₹92,235 crore, reflecting Suzlon’s large-scale presence in the industry.

P/E Ratio (TTM): 95.97, indicating investor expectations of high growth, although it’s relatively high compared to the industry.

P/B Ratio: 20.63, showing Suzlon’s valuation relative to its book value.

Industry P/E: 101.94, slightly higher than Suzlon’s P/E, suggesting Suzlon’s valuation is somewhat aligned with industry standards.

ROE (Return on Equity): 21.35%, reflecting Suzlon’s efficiency in generating returns from shareholders’ equity.

EPS (TTM): 0.71, indicating Suzlon’s earnings per share over the trailing twelve months.

Book Value: 3.30, which is a measure of Suzlon’s total assets minus its liabilities.

Debt to Equity: 0.06, demonstrating Suzlon’s low leverage and efficient debt management, a positive indicator for investors.

Dividend Yield: 0.00%, indicating that Suzlon currently does not pay a dividend, as it reinvests profits for growth.

Face Value: 2, which represents the nominal value of each share.

Also Read :

- Best Apple Stock Price Prediction From 2025 to 2030:Get Now

- Top 20 Nasdaq Companies In US Stock Market:Read Now

- IRFC Share Price Target 2025-2030: A Deep Analysis

- The Top 30 Companies in the Dow Jones: New By Weight

- Top 25 S&P 500 Companies in the USA: An Essential Guide

- Top 20 Leading Indicators of Recession in the USA Right Now

Suzlon Stock Price Prediction Table

| Year | Suzlon Share Price Target |

|---|---|

| 2025 | ₹130.00 |

| 2026 | ₹185.00 |

| 2027 | ₹230.00 |

| 2028 | ₹350.00 |

| 2029 | ₹450.00 |

| 2030 | ₹600.00 |

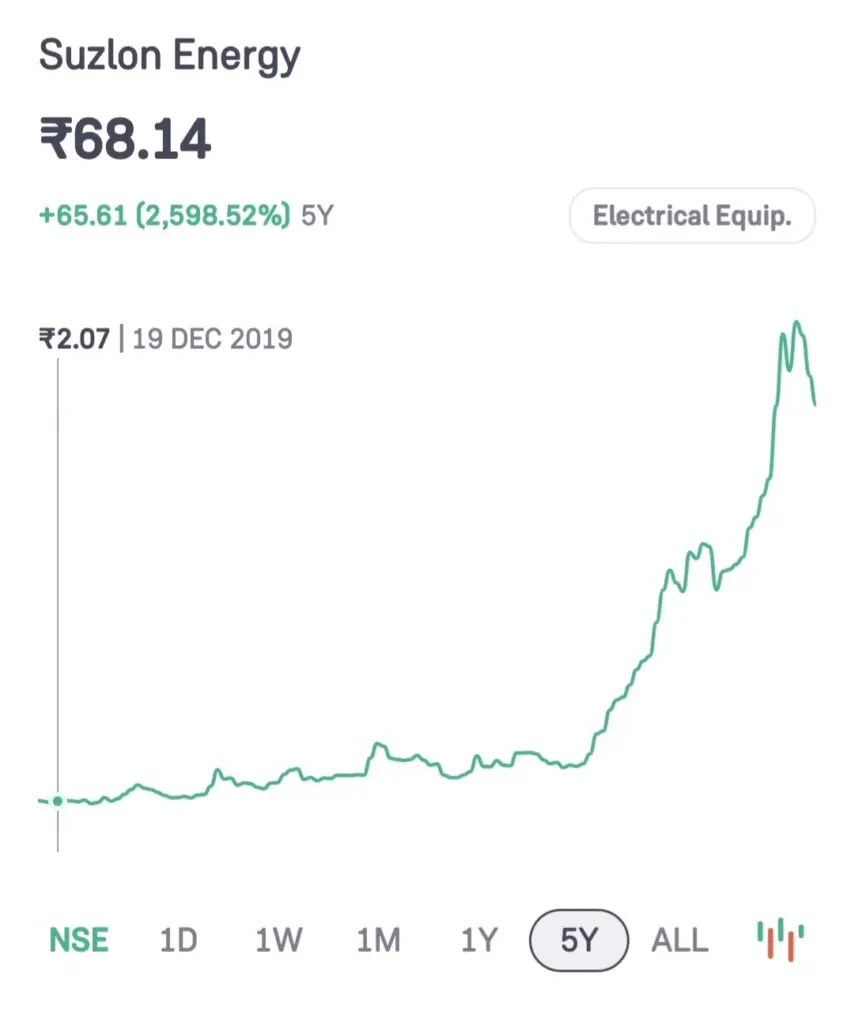

Suzlon stock Price Five Years Graph

The above five years graph shows that suzlon share price started its debut price approximately rs 2.07 in 2019 and now its current price in five years about 68 rs.

So this previous penny stock has turned into a Multibagger stock giving its investors 2,598% whopping returns.

Suzlon Energy Stock Price Target 2025

By 2025, Suzlon Energy is expected to make significant strides in the renewable energy market.

With its strong fundamentals, low debt-to-equity ratio of 0.06, and increasing market demand, the Suzlon Share Price Target for 2025 could reach around ₹130.00.

This growth would be supported by government incentives for renewable energy and Suzlon’s efficient cost management.

Suzlon Share Price Target 2026:

In 2026, Suzlon Energy’s growth momentum is expected to continue as it leverages its technological advancements and expands its market reach.

The Suzlon stock price target for 2026 is projected to be ₹185.00, driven by increased investment in clean energy and Suzlon’s consistent financial performance, including a high ROE of 21.35%.

Suzlon Stock Price Target 2027:

By 2027, Suzlon Energy is likely to be a key player in India’s energy transition, with continued demand for renewable solutions.

With sustained growth and a focus on expanding capacity, the Suzlon Share Price Target for 2027 is estimated to reach ₹230.00.

This target reflects Suzlon’s potential to strengthen its position in the market through innovation and strategic partnerships.

Price Target of suzlon For 2028:

In 2028, Suzlon’s growth trajectory could see a considerable increase as India intensifies its shift toward renewable energy.

The Suzlon stock price target for 2028 is anticipated to be around ₹350.00.

By this time, Suzlon’s advanced technology and robust market presence should enable it to capture a larger market share, making it a promising investment.

Suzlon Share Price Target 2029:

As we approach 2029, Suzlon Energy is expected to benefit from a mature renewable energy infrastructure in India.

With sustained government support and strong financials, the Suzlon Share Price Target for 2029 could reach ₹450.00.

This price target reflects Suzlon’s ongoing efforts to improve efficiency and expand its portfolio of renewable energy solutions.

Suzlon Share Price Target 2030:

By 2030, Suzlon Energy is poised to be at the forefront of India’s renewable energy market. The Suzlon stock price target for 2030 is projected to be ₹600.00.

This target is based on Suzlon’s anticipated growth in production capacity, market share, and profitability as renewable energy becomes a dominant source of power in India.

Factors Influencing Suzlon Energy’s Stock Price

Renewable Energy Demand:

As India transitions to cleaner energy sources, Suzlon Energy, a prominent player in the wind energy sector, is expected to benefit significantly.

Debt Reduction Efforts:

Suzlon’s efforts to reduce debt, as reflected in its low debt-to-equity ratio of 0.06, are likely to strengthen its financial stability and investor confidence.

Technological Advancements:

Innovations in renewable energy technology could reduce costs and improve Suzlon’s operational efficiency, directly impacting its stock price positively.

Government Policies:

Favorable policies and incentives from the Indian government to promote renewable energy will also boost Suzlon’s growth prospects.

Potential Risks Regarding Suzlon Price Target

Although Suzlon Energy’s outlook is positive, there are potential risks to consider:

Market Volatility:

The renewable sector is still evolving, and any fluctuations could impact Suzlon’s stock.

Competitive Pressure:

The growing number of competitors in the renewable energy industry might affect Suzlon’s market share.

Policy Changes:

Any shift in government policy regarding renewable energy could impact Suzlon’s growth trajectory.

Conclusion

Suzlon Energy has emerged as a strong player in India’s renewable energy market, backed by impressive fundamentals and a positive growth outlook.

For long-term investors, Suzlon Share Price Target projections for 2025-2030 suggest substantial potential returns.

However, keeping track of Suzlon’s financial performance and market developments will be essential to make informed investment decisions.

FAQs : Suzlon Share Price Target 2025-2030

What is the projected Suzlon share price target for 2025?

Based on current trends and analysis, the Suzlon share price target for 2025 is projected to reach ₹130.

Is Suzlon Energy a good investment for long-term growth?

Suzlon Energy has shown significant growth potential, with favorable fundamentals like a low debt-to-equity ratio and strong ROE. However, investors should conduct their own research and consider market risks before investing for the long term.

How does Suzlon’s P/E ratio compare to the industry average?

Suzlon’s P/E ratio is 95.97, which is slightly below the industry average of 101.94. This suggests that Suzlon may still have room for growth in comparison to other companies in the sector.

Why does Suzlon Energy have a 0% dividend yield?

Suzlon Energy currently does not provide dividends, as it likely reinvests profits to support business growth and expansion, which is common for companies focused on scaling up operations.

What is the Suzlon share price target for 2030?

The Suzlon share price target for 2030 is estimated to reach ₹600 if growth continues along the current trajectory and market conditions remain favorable.