Apple Stock Price Prediction From 2025 to 2030

Apple (AAPL). One of the most valuable companies in the world, has been a staple for investors seeking growth and stability.

Known for its innovative products, including the iPhone, Mac, and Apple Watch, as well as its expanding services sector, Apple has consistently demonstrated resilience and adaptability in the face of changing market dynamics.

As investors look to the future, they are eager to understand where Apple stock price might be headed over the next decade.

This article will provide you Apple stock price prediction from 2025 to 2030.

Table of Contents

Apple Stock Keywords Metrics

Below are the most important key metrics of Apple stock.Let discuss them one by one:

52-Week High and Low:

Apple’s stock has a 52-week high of $237.49 and a 52-week low of $164.08, highlighting a range of movement over the past year.

This range is essential for understanding the Apple stock forecast, as the stock’s position near its upper range suggests strong recent performance.

However, volatility may persist as it approaches this threshold, impacting AAPL stock future predictions.

Market Capitalization:

Apple holds a market cap of approximately 3.43 trillion USD, solidifying its status as one of the largest companies globally. This valuation plays a role in AAPL price target analysis, as market capitalization is a key metric investors use to evaluate Apple’s influence and stability within the tech industry.

P/E Ratio:

Apple’s Price-to-Earnings (P/E) ratio stands at 37.13, which is above average compared to many companies. This suggests that investors are willing to pay a premium for Apple’s earnings, indicating confidence in Apple stock future value and a strong AAPL earnings outlook.

Dividend Yield:

Offering a dividend yield of 0.44%, Apple provides modest income to its shareholders, although its primary appeal remains in potential stock price appreciation. For income-focused investors, this yield is an attractive feature alongside the Apple stock long-term outlook.

CDP Score:

Apple’s environmental rating, or CDP score, is graded at A-.

This score signifies Apple’s commitment to sustainability and environmental responsibility, a factor increasingly important for ESG-conscious investors who look favorably on AAPL stock market forecast trends.

Also Read :

- IRFC Share Price Target 2025-2030: A Deep Analysis

- The Top 30 Companies in the Dow Jones: New By Weight

- Top 25 S&P 500 Companies in the USA: An Essential Guide

- Top 20 Leading Indicators of Recession in the USA Right Now

- Top 10 ESG Stocks for Sustainable Investing in the USA Now

- Top 10 AI Stocks Set to Soar in USA 2024

- Top 10 Healthcare Stocks for Long-Term Growth In USA Right Now

- What to Expect from the U.S. Stock Market After the 2024 Elections

- Top 10 Penny Stocks to Invest in the US Market for Long-Term Growth

- Top 10 High Dividend Stocks To Invest In The USA Now

- Top 10 High Earning Stocks to Invest in USA 2024

Factors Affecting AAPL Stock Price

Product Innovation:

Apple’s success is heavily dependent on its product ecosystem.

New product launches, software updates, and technological advancements directly influence the Apple stock price projection.

The market responds strongly to any announcements regarding the iPhone, iPad, Mac, or other flagship products.

Macroeconomic Conditions:

Operating globally, Apple is influenced by international economic conditions, currency fluctuations, and consumer spending patterns, all of which impact AAPL stock trend prediction. Global economic challenges or currency volatility can affect Apple’s revenue streams and profitability.

Environmental and Social Governance (ESG) Factors:

As shown by its A- CDP score, Apple’s focus on sustainable practices is gaining attraction among ESG investors.

Commitments to environmental responsibility and ethical supply chain management are increasingly significant in assessing the AAPL stock long-term outlook.

52-Week High and Market Sentiment:

With Apple trading close to its 52-week high, investor sentiment remains positive, which can influence Apple share price estimates.

However, as it approaches this peak, there could be profit-taking, potentially causing short-term downward pressure on the stock.

Analyst Predictions For Apple Stock Price Target

Analysts remain optimistic about Apple’s future performance, with many setting target prices that exceed its current range, some aiming beyond $250.

This bullish outlook is fueled by Apple’s strong financial health, innovative capabilities, and loyal customer base.

Such AAPL stock future predictions reflect a consensus that Apple may continue to perform well in the medium to long term.

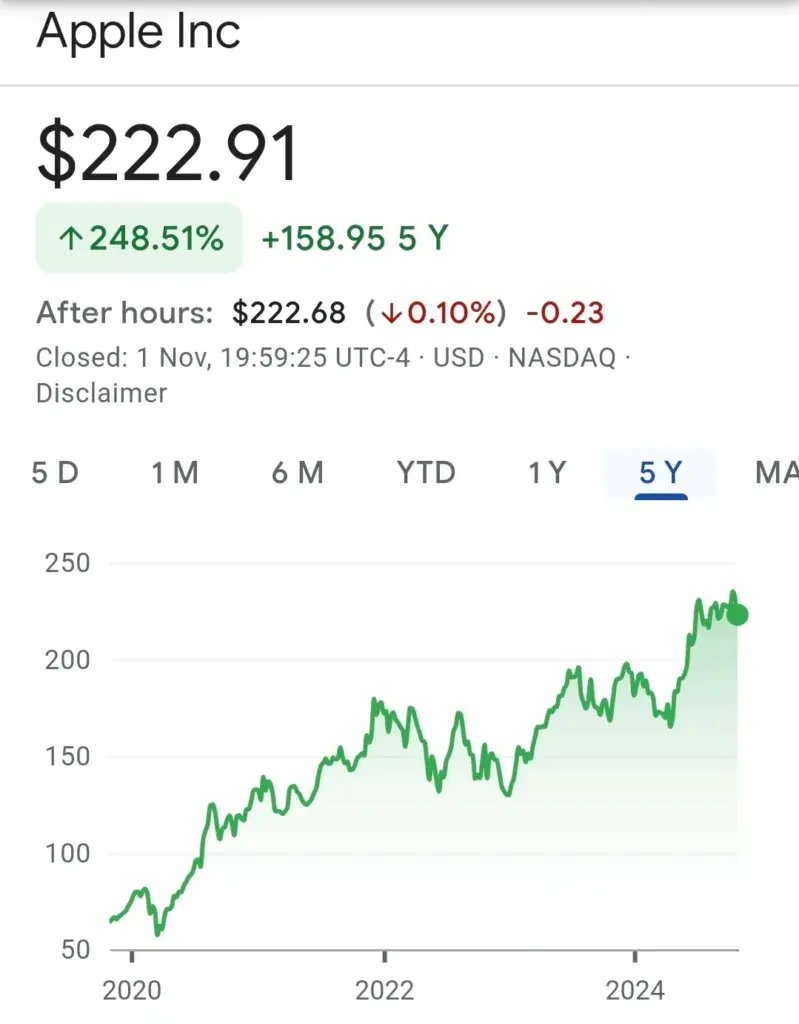

Apple Stock Price Graph

Above graph clearly shows how well Apple stock has performed from 2020 to till the year.

So, for long term investors Apple stock has almost generated four times income.

Apple Stock Price Prediction for 2025-2030

As one of the world’s leading tech giants, Apple continues to capture investor interest, with many speculating on the Apple stock forecast for the long term.

Based on current market trends, innovation potential, and investor sentiment, here are the anticipated price targets for Apple stock in the coming years.

| YEAR | Apple STOCK PRICE PREDICTION |

|---|---|

| 2025 | $300.28 |

| 2026 | $370.69 |

| 2027 | $445.98 |

| 2028 | $472.38 |

| 2029 | $537.73 |

| 2030 | $661.26 |

Apple Price Target for 2025:

$300.28

By 2025, Apple’s stock is expected to reach around $300.28.

This Apple stock price projection is based on continued growth in Apple’s product ecosystem and potential new innovations.

The focus on sustainability and user-centric technology is likely to drive demand, helping Apple maintain its position as a market leader.

Apple Price Target for 2026: $370.69

In 2026, analysts predict Apple’s stock could rise to $370.69.

With possible expansion in AI, augmented reality, and health-related technology, AAPL price target analysis shows Apple’s growth could accelerate.

Strategic acquisitions and an expanded product lineup may further enhance Apple’s market dominance.

Apple Price Target for 2027: $445.98

The forecasted price for Apple stock in 2027 is $445.98.

As Apple continues to innovate across hardware, software, and services, it could benefit from increased consumer adoption, contributing positively to AAPL stock market forecast models.

Apple Price Target for 2028: $472.38

By 2028, Apple’s stock could reach $472.38. Growth in Apple’s services segment, along with advances in wearable technology, may sustain investor confidence.

This AAPL stock trend prediction reflects Apple’s brand loyalty and expansion into new sectors.

Apple Price Target for 2029: $537.73

The price prediction for 2029 suggests Apple’s stock could climb to $537.73. Increased investment in R&D and potential new revenue streams from innovative products are anticipated, supporting AAPL stock future predictions that see it remaining dominant.

Apple Price Target for 2030: $661.26

Looking to 2030, analysts estimate Apple’s stock could reach as high as $661.26.

This Apple share price estimate reflects the potential impact of continued focus on cutting-edge technology, sustainable practices, and service expansion.

Final Thoughts on Apple’s Long-Term Price Targets

Apple’s projected growth over the next decade reflects optimism about its innovative capabilities and market resilience.

These AAPL stock trend predictions represent a favorable outlook; however, actual performance will depend on economic conditions, competitive dynamics, and Apple’s ability to deliver transformative products and services.