IRFC share price Analysis: Overview, Fundamentals, Investment Potential and Future Price

The Indian Railway Finance Corporation (IRFC) has emerged as a significant player in the financial market,especially for those interested in infrastructure and finance-related stocks.

The recent glance at IRFC’s stock data provides insights into the company’s financial metrics, stock performance, and investment potential.

Table of Contents

IRFC Share Price Performance Overview

IRFC’s stock is currently priced at ₹155.96, reflecting a minor increase of 0.26% (₹0.41) in the last trading session.

With its 52-week range spanning from ₹71.05 to ₹229.00, this stock has seen substantial volatility, allowing investors to capitalize on price fluctuations.

For new and seasoned investors alike, this data can help in understanding the stock’s performance and potential growth trajectory.

- 52-Week Low: ₹71.05

- 52-Week High: ₹229.00

- Current Price: ₹155.96

IRFC Stock Opening and Closing Details

The stock opened at ₹155.40 and closed the previous day at ₹155.55.

This minimal difference indicates a period of stability for the stock, which can be attractive to long-term investors seeking steadier investments.

- Open: ₹155.40

- Previous Close: ₹155.55

Trading Volume and Circuit Limits Of IRFC Share

IRFC has a significant daily trading volume, with the latest data showing approximately 5.55 crore shares traded.

Such high liquidity is beneficial for investors, as it ensures ease of buying and selling without major price impacts.

Additionally, the lower and upper circuit limits, set at ₹124.76 and ₹187.15 respectively, help control excessive volatility, protecting both the stock and its investors.

- Volume: 5,55,31,774 shares

- Lower Circuit: ₹124.76

- Upper Circuit: ₹187.15

Fundamental Analysis Of IRFC Stock

A deep dive into IRFC’s financial fundamentals reveals insights that help in assessing its intrinsic value and potential for growth.

Some of the key indicators include market capitalization, P/E ratio, and dividend yield.

Market Capitalization (Mkt Cap):

IRFC’s market cap is a robust ₹2,03,869 crore, placing it among the large-cap stocks. This indicates the company’s strong position in the financial sector, making it a relatively stable investment choice.

P/E Ratio (TTM):

IRFC has a Price-to-Earnings ratio of 31.64, which is above the industry average (Industry P/E at 25.89).

While a higher P/E ratio might indicate that the stock is slightly overvalued, it also reflects investors’ confidence in the company’s growth prospects.

P/B Ratio:

The Price-to-Book ratio is 4.02, providing insight into the company’s valuation relative to its book value. A P/B ratio above 1 generally indicates that the stock might be valued higher than the company’s assets, which can be both positive and negative depending on the investor’s perspective.

Dividend Yield:

With a dividend yield of 0.96%, IRFC offers a modest return to its shareholders through dividends. While this yield is not exceptionally high, it provides an additional source of income for long-term investors.

ROE (Return on Equity):

The return on equity for IRFC stands at 12.69%, indicating the company’s efficiency in generating profit relative to shareholder equity. A double-digit ROE is generally favorable and signifies that IRFC is effectively utilizing its equity base.

Debt-to-Equity Ratio:

IRFC’s debt-to-equity ratio is notably high at 8.02. This high level of leverage could be a concern as it indicates a reliance on borrowed capital. However, given IRFC’s role in financing railway infrastructure, the high debt is likely a result of its business model rather than inefficiency.

Book Value:

The book value per share is ₹38.85, which can be helpful in assessing the stock’s valuation relative to its net asset value.

EPS (Earnings Per Share):

IRFC’s Earnings Per Share (TTM) stands at ₹4.93, providing a snapshot of the company’s profitability on a per-share basis. This metric is essential for investors in evaluating the return they might expect per share.

Face Value:

The stock has a face value of ₹10, which is mostly relevant for dividend calculations and stock split considerations.

You May Also Read :

- The Top 30 Companies in the Dow Jones: New By Weight

- Top 25 S&P 500 Companies in the USA: An Essential Guide

- Top 20 Leading Indicators of Recession in the USA Right Now

- Top 10 ESG Stocks for Sustainable Investing in the USA Now

- Top 10 AI Stocks Set to Soar in USA 2024

- Top 10 Healthcare Stocks for Long-Term Growth In USA Right Now

- What to Expect from the U.S. Stock Market After the 2024 Elections

- Top 10 Penny Stocks to Invest in the US Market for Long-Term Growth

- Top 10 High Dividend Stocks To Invest In The USA Now

- Top 10 High Earning Stocks to Invest in USA 2024

IRFC Future Price Target Forecasts 2025-2030

| Year | Share Price Target |

|---|---|

| 2024 | ₹280.08 |

| 2025 | ₹380.16 |

| 2026 | ₹466.48 |

| 2027 | ₹510.10 |

| 2028 | ₹605.60 |

| 2029 | ₹720.40 |

| 2030 | ₹801.05 |

Based on the current financial data and projected growth rates, here’s an estimated forecast for IRFC’s share price from 2024 to 2030.

These projections are speculative and depend on several factors including market conditions, economic policies, and IRFC’s financial performance.

Investors should use these estimates as part of a broader investment strategy.

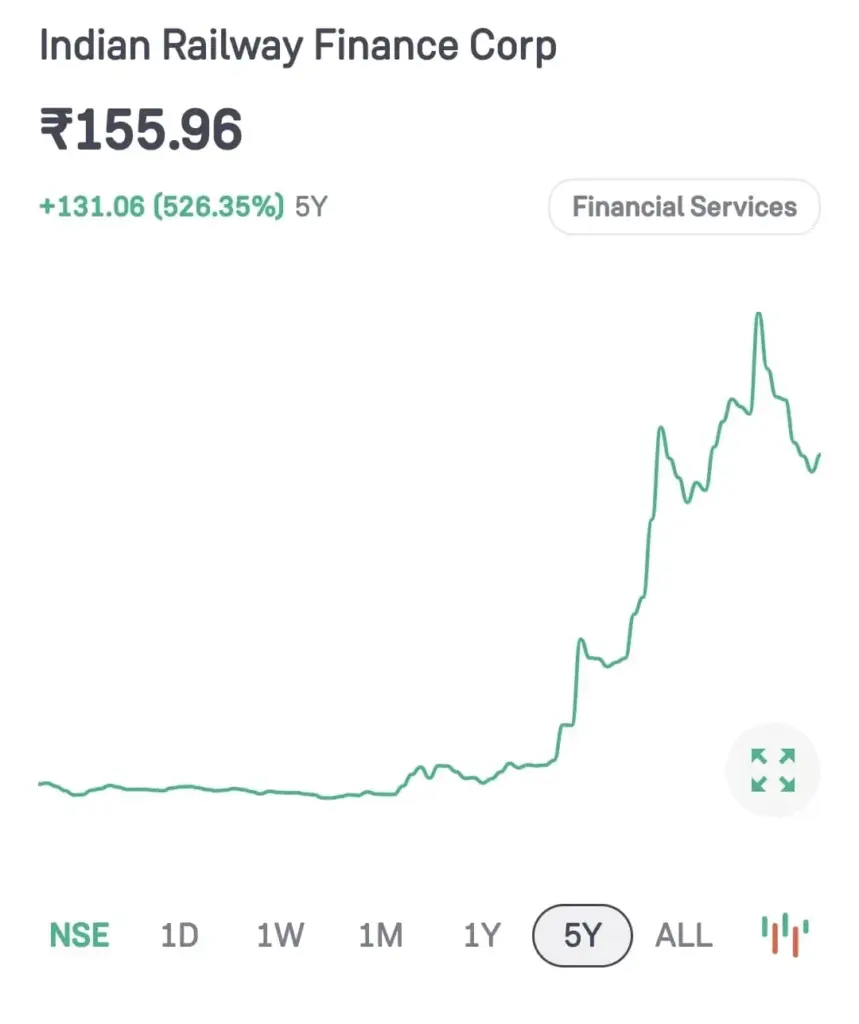

IRFC Share Price in Previous 5 Years

From the above graph, we can see that IRFC stock has given a huge return of massive 526.35% in last five years.

So for long term investors, it has given over 300 times returns.

Moreover, IRFC Stock started it debut with 25.40 rs per share back in 29-jan-2021. And now its current price crystal clear in the above graph.

IRFC Stock Investment Potential and Risk Assessment

Investors interested in IRFC should consider both the opportunities and risks associated with this stock:

Growth Potential:

With the Indian government’s focus on expanding and modernizing railway infrastructure, IRFC plays a key role as a financing partner, which may drive the company’s growth.

Dividend Income:

While IRFC’s dividend yield is relatively modest, it offers a consistent income stream, making it attractive for income-focused investors.

High Leverage:

The high debt-to-equity ratio suggests significant financial leverage. While this can amplify returns, it also introduces risk, especially if interest rates rise or if the company’s revenue generation faces hurdles.

For More Details Kindly Visit :

IRFC Official Website

Conclusion

IRFC’s stock presents a mixed picture. The company’s high market cap, steady growth, and essential role in infrastructure financing provide it with a strong foundation.

However, the high P/E ratio and debt levels may pose risks for some investors. As always, potential investors should conduct their own due diligence and assess their risk tolerance before investing.

For those with a long-term investment horizon and an interest in India’s infrastructure development, IRFC may be a worthy consideration in a diversified portfolio.

These price targets are projections based on IRFC’s current position, historical growth, and anticipated future market trends.

FAQs About IRFC Stock Price Prediction

What is the IRFC share price target for 2025?

The target share price for IRFC in 2025 is ₹380.16

What is the projected share price for IRFC in 2028?

The projected share price for IRFC in 2028 is ₹605.60.

What is the highest share price target listed in

The highest share price target listed in the table is ₹801.05 for the year 2030.

What trend can be observed in the share price targets from 2025 to 2030?

The share price targets show a consistent upward trend, increasing each year, with significant growth anticipated, particularly from 2025 to 2030.

Should You Invest In IRFC Stock?

Yes, you can.But it is not our advice.As you know, investing in any stock carries huge market risk.

If you are a long term investors,you can think of investment.